Understanding the intricacies of forensic accounting

Kavitha delivering a talk on Forensic Accountants and Fraud

UTAR Knowledge Sharing and Communication Committee from the Centre for Foundation Studies (CFS) of Kampar Campus organised a webinar titled “Forensic Accountants: White-collar CSIs and Their Role against Fraud” on 21 August 2021 via Zoom. The webinar saw a total of 100 attendees. It was moderated by CFS Department of Arts and Social Science lecturer S. Tulasi.

The webinar aimed to address the job scopes and intricacies of a gradually emerging field, namely forensic accounting as well as its vital role in uncovering and combating digital fraud. It also aimed to provide participants with some crucial tips on achieving heightened security and fraud prevention using digital tools.

Present to deliver the webinar was A. Kavitha. She is the Programme Leader and lecturer for the Accounting Programme at Asia Pacific University of Technology and Innovation. With over 10 years of experience in the field of forensic accounting and taxation, Kavitha was recently featured as a guest on BFM Radio’s aired show titled “White Collar Crime”. She is also an active advocate of forensic accounting.

Kavitha (left) and Tulasi (right) during the webinar

Kavitha (left) and Tulasi (right) during the webinar

Kavitha started the webinar by introducing the concept “White Collar Crime” and explaining the importance of forensic accountants. According to Kavitha, White Collar Crime is a crime committed by the people in ‘status’ in the course of ‘occupation’. It is usually done by those who work at the upper level of an organisation. White Collar Crime is also an umbrella term that refers to crimes such as investment scams, money laundering, embezzlement, financial statement fraud and other categories of fraud.

Kavitha said, “Many people think that White Collar Crime is victimless because it is a nonviolent crime. However, the White Collar Crime is a severe crime because a single scam can destroy a company, devastate families by wiping out their life savings, or cost investors billions of dollars.”

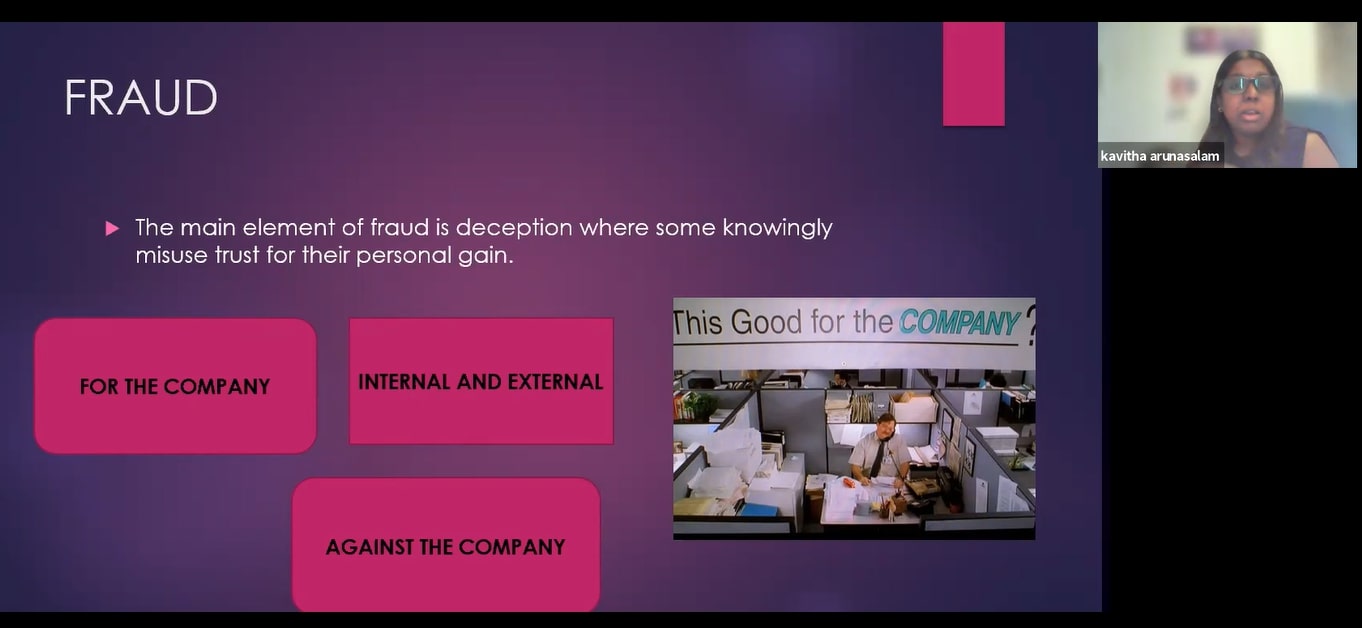

Kavita speaking about fraud in an organisation

In her talk, Kavitha shared her personal experience as a forensic accountant and talked about the different types of fraud she encountered during her job. The main element of fraud is deception where some knowingly misuse trust for their personal gain. There are different types of fraud that occur in society, such as fraud for the company, fraud against the company, internal and external fraud and occupational fraud. Occupational fraud is committed by an organisation’s employee. As forensic accountants, their job is to detect, investigate and prevent all these frauds.

According to Kavitha, the majority of the cases detected in society was occupational fraud. Occupational fraud can be classified into three main areas, namely corruption, asset misappropriation and financial statement fraud. Usually, financial statement fraud is committed by management-level staff, such as the chief executive officer (CEO) or chief financial officer (CFO). These people at the management level manipulate the figure to show the company they are bringing more income to the company as proof of being valuable to the company. In order to get more bonuses, they manipulate the figures.

Asset misappropriation happens when people who are entrusted to manage the assets of an organisation, steal from it. Around 86% of fraud cases detected by forensic accountants are asset misappropriation. Kavitha explained, “This fraud is probably most common because it could be done by employees who are not only from the management level. Asset misappropriation always involves skimming and larceny (off-book scheme and on book scheme), billing scheme (attacks purchasing function), payroll scheme (ghost employee) and expenses reimbursement (overstate expenses).”

Kavitha showing participants various activities related to asset misappropriation

Kavitha stressed on the need for a forensic accountant to understand the different types of fraud, “A forensic accountant needs to know the various types of fraud because the clients usually do not know what has happened in their companies. The clients can only tell the symptoms they found, not the type of fraud that had happened. The symptoms could be like the products selling good but the sales do not increase, or the products were listed on Lazada or Shopee but the company did not put them there. We will listen to the symptoms and come out with hypotheses of what could have happened in the company. After we come out with the hypotheses, we will investigate and test the hypotheses. As forensic accountants, we have to know the details of how a particular fraud functions. Then, we find evidence to prove it.”

The difference between a forensic accountant and an auditor lies in their work purpose. Compared to an auditor who examines financial statements and ensures the accounting standards are followed, a forensic accountant focuses more on preventing, analysing and uncovering possible fraud to be presented in the court. Kavitha mentioned several skills that are required to become a forensic accountant, such as having accounting knowledge, investigation skill, audit skill, criminology knowledge and legal knowledge.

Kavitha listing the skills required to become a forensic accountant

Speaking of why frauds are committed, Kavitha introduced a theory called the “Fraud Diamond”. Fraud Diamond contributes to the understanding of fraud, especially by forensic accountants. She said, “According to the fraud diamond theory, there are four elements that influence a person to commit fraud, namely pressure, opportunity, rationalisation and capability. When the organisation lacks control, people see an opportunity and take advantage of it. Both financial and non-financial pressure could become the motivation for a person to commit fraud. Sometimes, people commit fraud just because they are capable of doing it. These people are usually intelligent and have the necessary traits or skills that could help them steal money.”

She added, “As forensic accountants, we analyse the company and look into the company scenario before we give prevention ideas based on the organisation. We apply the DIP method, namely ‘Detect, Investigate and Prevent’.”

She then moved on to introduce Fraud Prevention – the implementation of a strategy to detect fraudulent transactions or banking actions and prevent these actions from causing financial and reputational damage to the customer and financial institution. The internal controls of fraud prevention consist of methods involving the control of the environment, assessment of risk, control of operational activities, monitoring of control processes as well as accurate communication of information.

“Surprisingly, small companies that contain fewer than 100 employees are the ones that usually face higher risk and larger losses due to Occupational Fraud. These types of companies cannot place in prevention mechanisms because they cannot come up with proper supply audits or anti-fraud policies. Hence, fraud education is very important and this is something which every organisation have to look into and work on it,” said Kavitha.

The insightful webinar ended with an interactive Q&A session and a group photography session.

During the Q&A sessions, Kavitha highlighted that we are not in the stage where we can rely on technology to prevent fraud. She gave examples like Encase MK LTD and forensic toolkit— the software applications that have always been used by forensic accountants to ease their job.

“Although these software applications are easily found on Google, the data still need to be analysed by a forensic accountant. According to a survey, many organisations are still not aware of using these software applications to prevent fraud and have no training on how to use the technology. These technology tools can be used to ease the job, however, the investigation itself needs to be carried out manually by a forensic accountant,” said Kavitha.

Kavitha (top row, most right) with the participants